2024 Schedule A Deductions Chapter – The standard deduction is advisable when it is greater than your total itemized deductions listed on Schedule A. . Itemized deductions (Schedule A), deductions and expenses from freelance or self-employed work (Schedule C), or HSA distributions (1099-SA). $0 + $0 per state filed. It allows you to file a 1040 f .

2024 Schedule A Deductions Chapter

Source : www.irs.govJames Patterson Imagine the insanely clever | Facebook

Source : m.facebook.comCollege Visits & Advising Shawnee Mission North High School

Source : smnorth.smsd.orgSouth Sound Chapter Meeting 2023 and 2024 Tax Update for

Source : cfma.orgSection 179 Deduction – Section179.Org

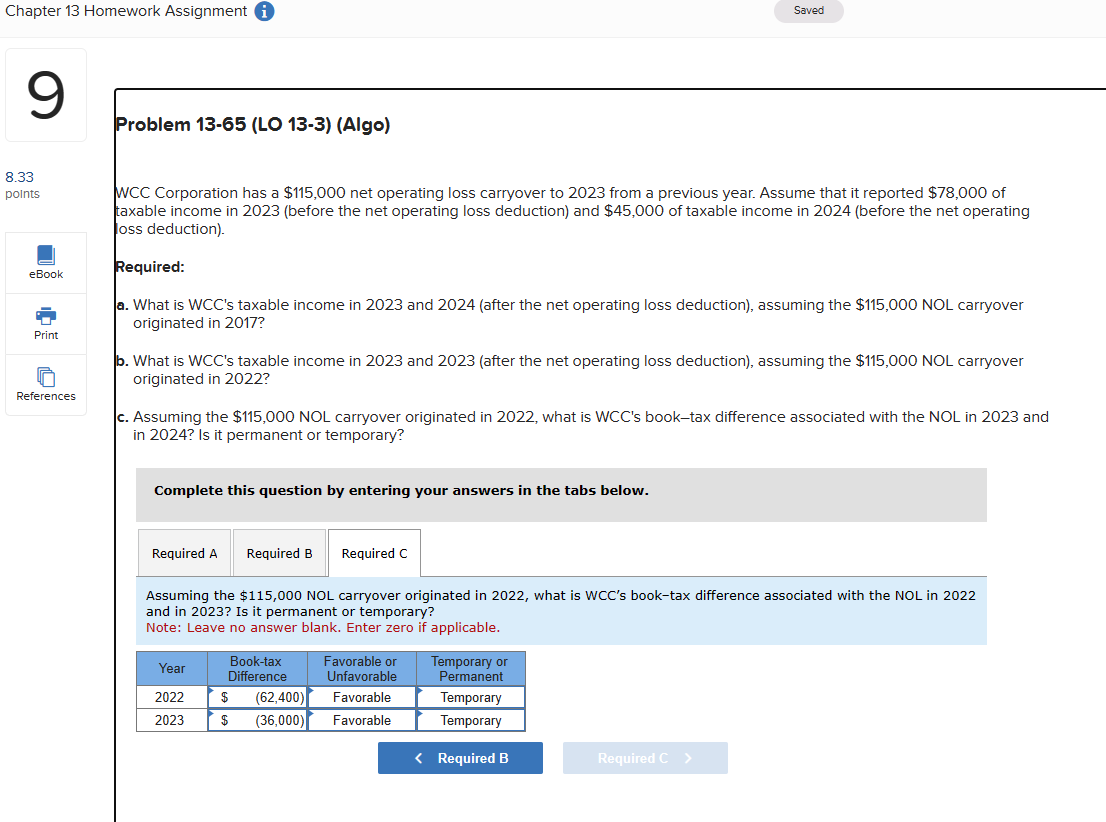

Source : www.section179.orgSolved WCC Corporation has a $115,000 operating loss | Chegg.com

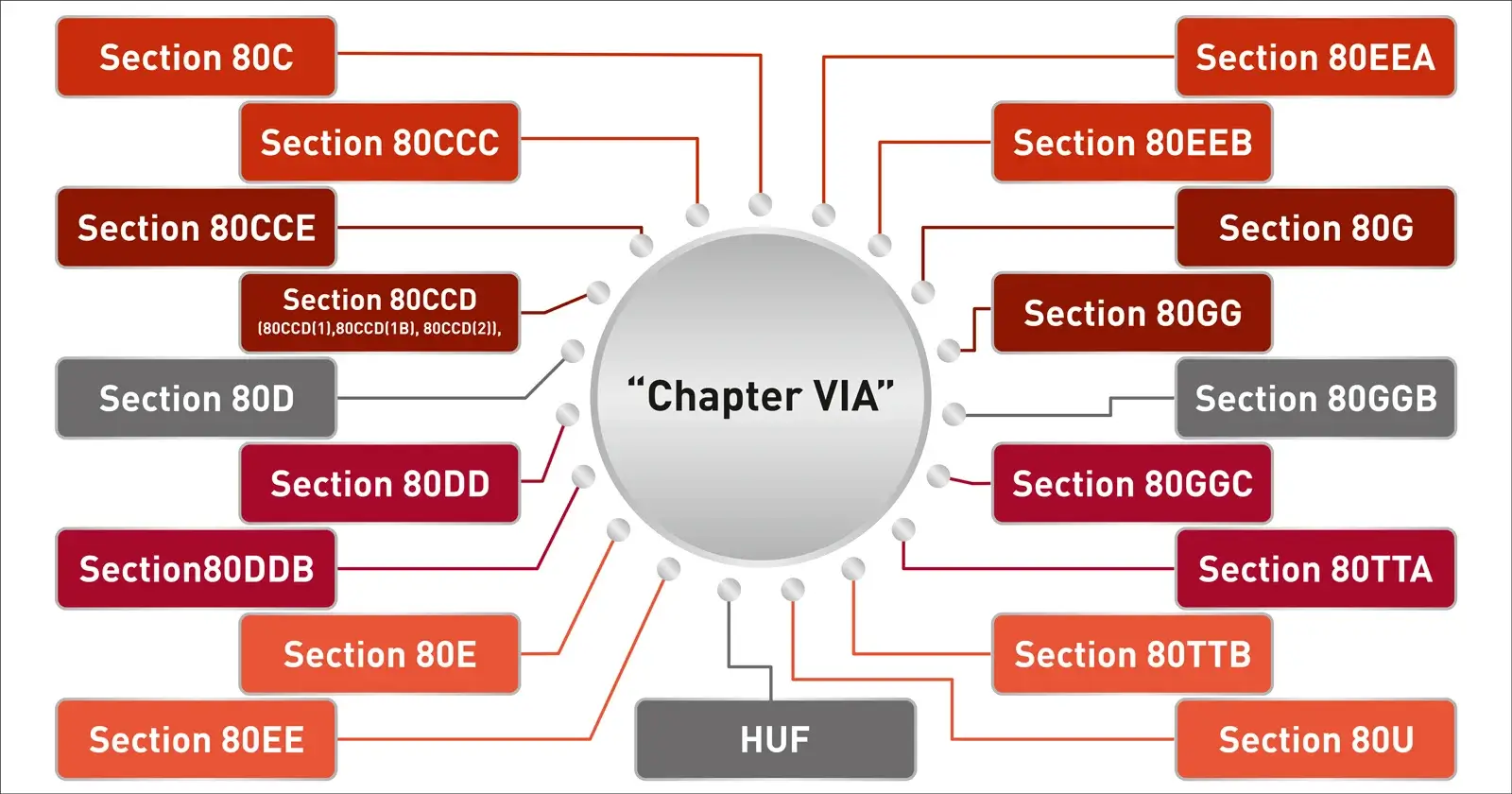

Source : www.chegg.comDeductions under Chapter VIA

Source : life.futuregenerali.inNew Mexico Chapter | Alzheimer’s Association

Source : www.alz.orgAVAILABLE] South Western Federal Taxation: Individual Income Taxes

Source : www.reddit.comZeigler & Barnes Financial Services

Source : www.facebook.com2024 Schedule A Deductions Chapter Publication 505 (2023), Tax Withholding and Estimated Tax : If you owe taxes and don’t file by the deadline, you will be subject to penalties and interest on the unpaid amount. . In olden days, your accountant would add $30,000 to your equipment schedule and, because the IRS tables say a That would be part of line 14 on your 2023 Chapter S Tax return. Section 179 was .

]]>